Liam Horne

Making Sense of Tether on Tron

Written in November 2023

My friends that work on Ethereum tend to be very surprised once they realize the most used cryptocurrency for payments is Tether on Tron. I was too when I first found out. Recently, I started to look more into it and here is what I learned!

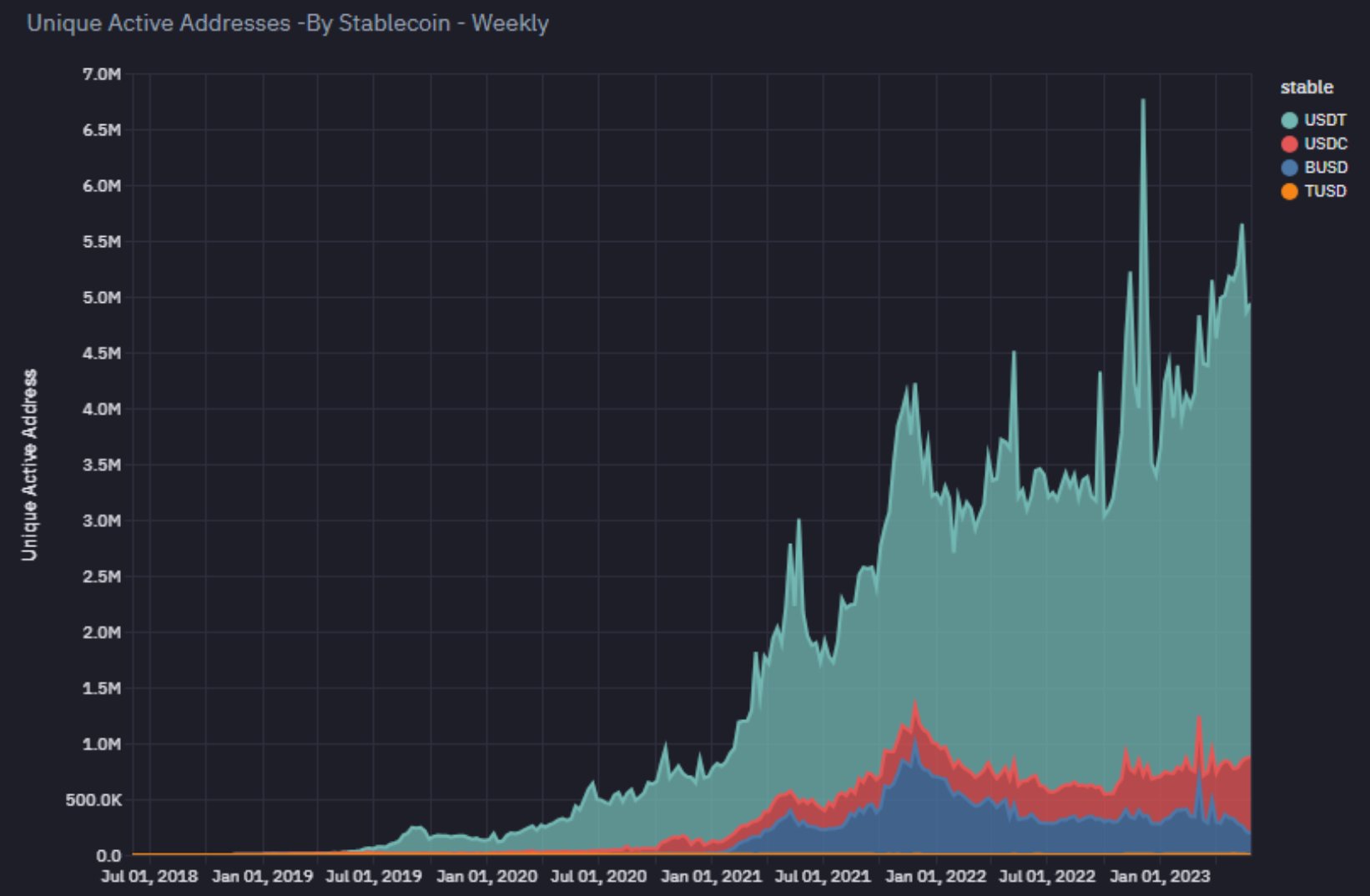

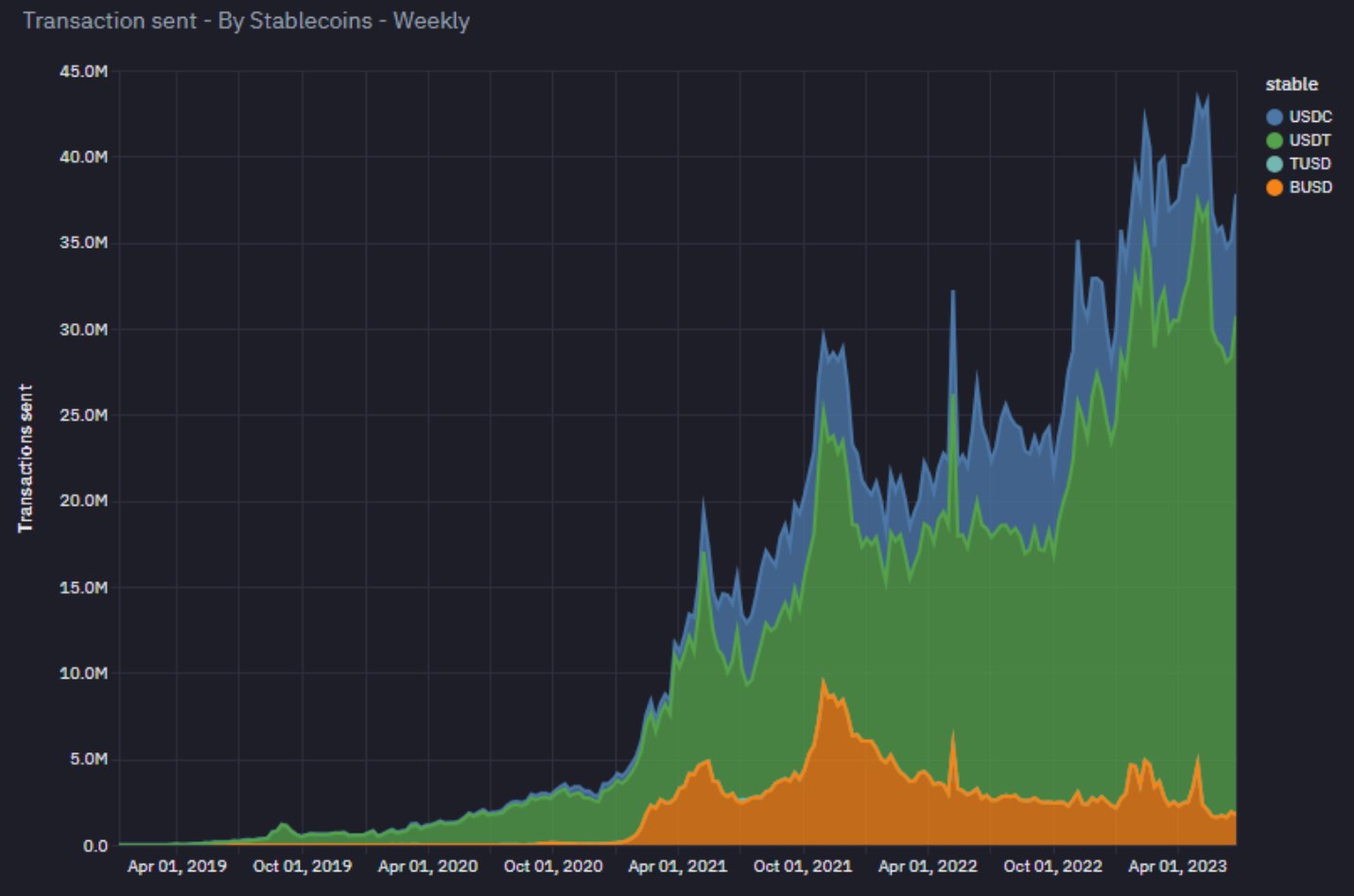

Stablecoins grew exponentially over the last five years

Global access to the US dollar has really turned out to be a killer app. They’re used for all kinds of things, like inter-exchange settlement, cross-border payments, and accessing a dollar product in countries with strict capital controls.

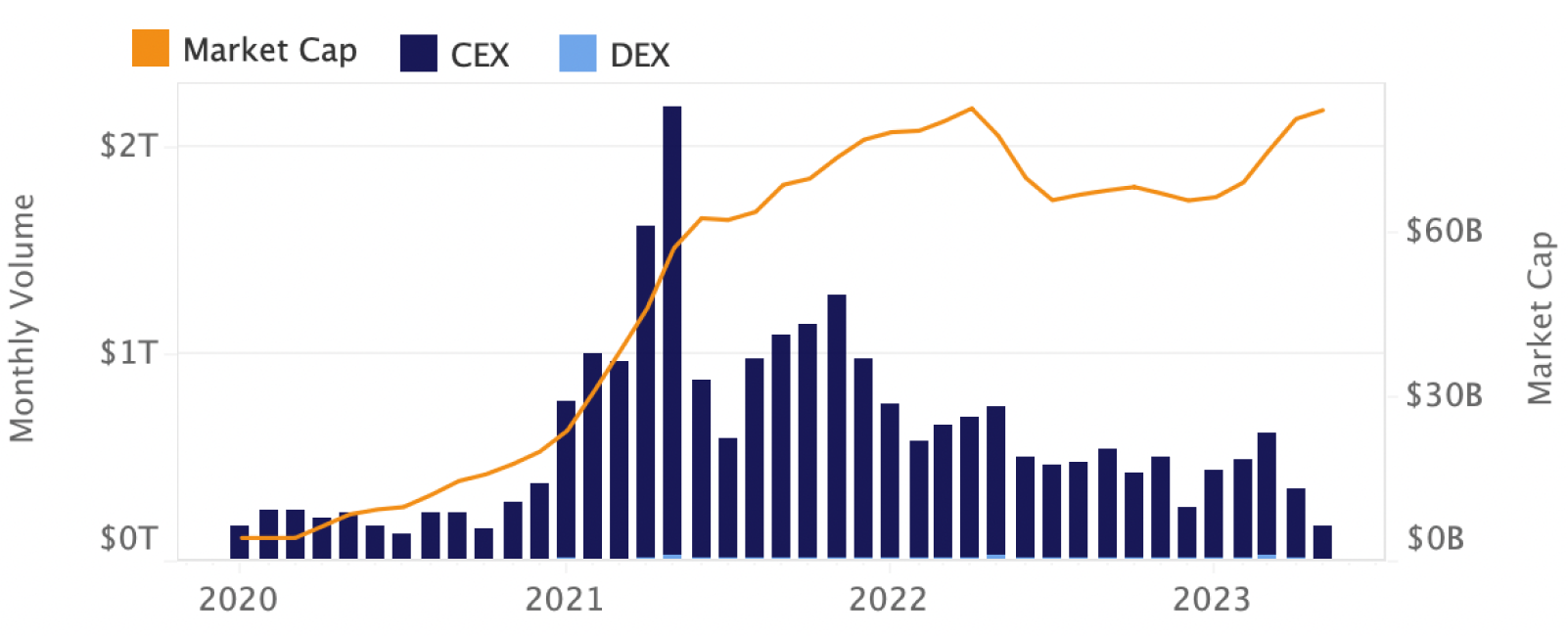

They’re growing really fast, over 100% year-over-year in the past five years, from under $3B to over $125B1 of stablecoins in circulation today. Stablecoins today make up 70% of all cryptocurrency transaction volumes despite only composing 10% of the entire cryptocurrency market cap!2

Stablecoins even surpassed PayPal in total settlements in 2022: over $11T1 of volume settled on blockchains! That’s almost the size of the entire Visa network ($11.6T1).

Even in bear markets for cryptocurrency trading, they continue to gain adoption. Since the end of 2021, stablecoin transaction volumes have dropped only 11%, compared to centralized exchange volumes, which are down 64%.

|

|

|---|---|

Stablecoins seriously help people that need stable money

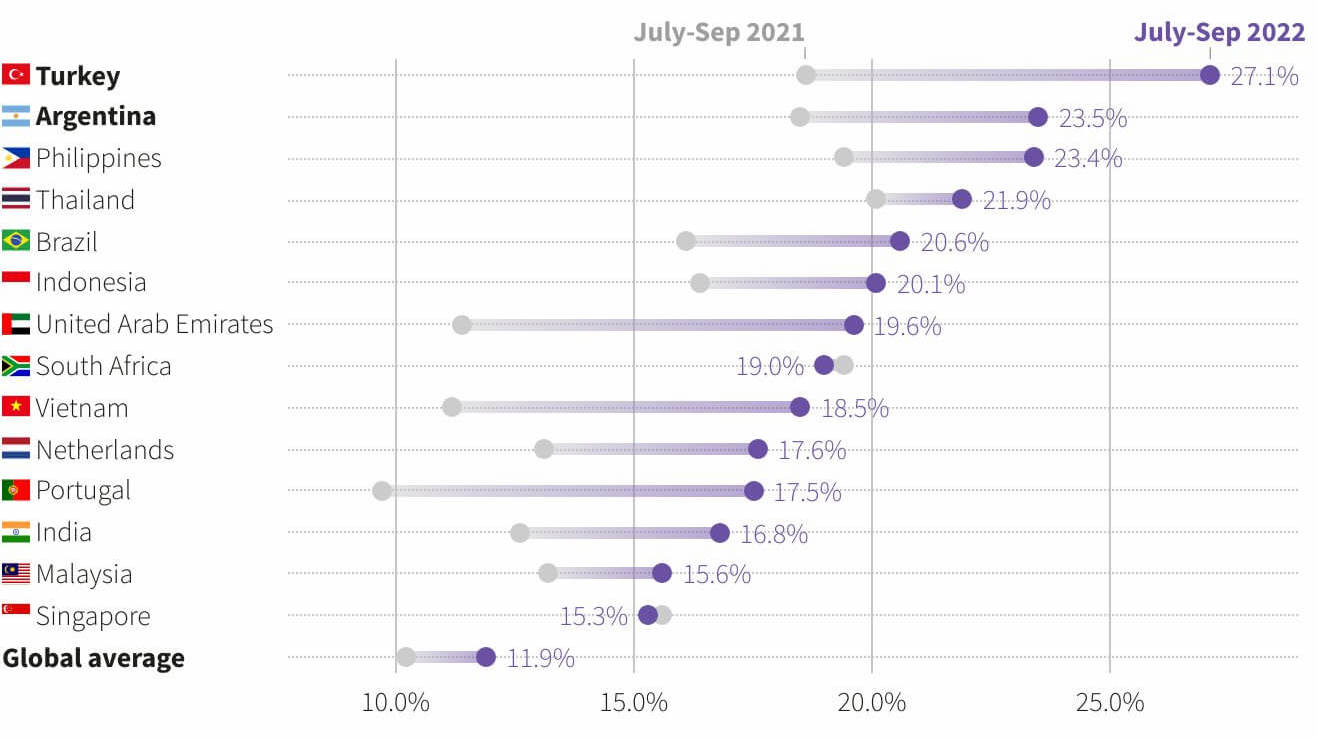

More than a third of Latin American consumers say they have made a payment for an everyday purchase with stablecoin, at least according to a study conducted by Mastercard. They claim from their survey data that 51%3 of consumers in the region have already made at least one transaction with some cryptocurrency.

Once you look into it though, it’s obvious why. People living in countries with failing monetary policy like Argentina have experienced 100%4 annual inflation for over a century. They quite simply need stability in their money and stablecoins provide that. They help people preserve the wealth they’ve accumulated.

This is such a hair-on-fire problem for Argentinians that their new president is planning on moving the entire economy to the US dollar!

In Turkey, the Lira inflated by 80.5% in 2022 making not only stablecoins but cryptocurrencies in general ways for people to preserve wealth. According to data from research by GWI, ownership of cryptocurrencies is the highest in the world, at 27.1%5, well above the average of 11.9% globally.

In Istanbul, it’s common to see stores in densely populated areas where you can convert your Lira, USD, or EUR in and out of USDT. Some friends and I visited those stores to understand more about how Turkish people are using stablecoins last year.

|

|

|---|---|

Businesses are building consumer finance apps with stablecoins

For instance, Lemon lets more than 2M6 customers in Latin America store their stablecoins like they would with a traditional bank and even spend them using a credit card on the Visa network. Funds customers lend to Lemon are custodied7 as USDT on Ethereum or invested into BTC on Bitcoin. They’ve seen a 200x growth in active users since 2021.

Larger fintech businesses are also starting to meet this demand. For instance, the Mercado Pago (the fintech arm of Latin America’s version of Amazon, which has 200M users) is starting to support payments made by users in USDC and USDP across Latin America, starting in Chile8 and Mexico9.

Yellow Card provides fiat payment and disbursement solutions in 16 African countries. They handle all accounting and settlement of the funds between countries by using stablecoins like USDT. Effectively, they’re enabling cross-border money transfers by using stablecoins as the backend instead of existing cross-border banking infrastructure.

And infrastructure is being built for businesses with stablecoins

With all of these products being built that lean on stablecoins, it’s becoming clear that infrastructure serving them is important to be built too. Some companies are already recognizing the opportunity to build picks and shovels for a wave of stablecoin adoption.

Bridge, for example, offers APIs for developers of fintech businesses to move between any stablecoin to any other stablecoin. In a sense, they’re unbundling the part of an exchange like Coinbase that allows users to “deposit” and “withdraw” with fiat money and turning that into a service to be integrated in other apps.

Even Visa, the largest payment processor in the world, is beginning to pilot stablecoins for merchant settlement as an alternative to traditional banking.10 From a pilot Visa did with Crypto.com, they were able to have reduced the time it took to prefund transactions by 50% and reduce foreign exchange fees.

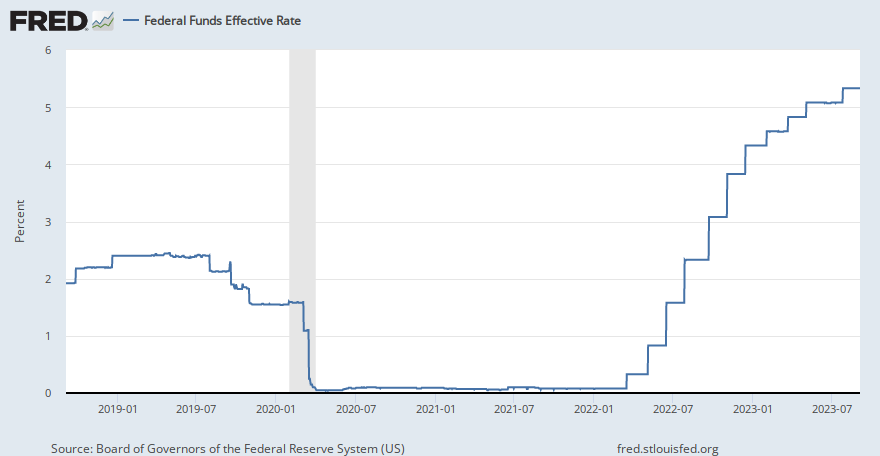

Stablecoin issuers are benefiting from higher interest rates

For stablecoin issuers, the recent rise in interest rates has been incredibly profitable.

Tether, the issuer of the largest stablecoin USDT, has a market cap of ~$82.9B11 today. They’ve stated that at least $72B12 of those funds are held in US treasury bonds with Cantor Fitzgerald13. Tether owns more US Treasury Bills than Australia, Spain, and the United Arab Emirates.14 With federal rates at 5%15, Tether is able to make billions from the interest alone.

The interest on stablecoin deposits are so large that, Coinbase, the largest crypto business in the US is making significant double-digit percentages of its revenue via a revenue share with Circle. In Q2 of 2023, the revenue from interest on the reserves accounted for $201.4M16.

|

|

|---|---|

How did we get here?

Tether was the first to establish the utility of stablecoins

Today, Tether's USDT represents 69% of the entire stablecoin supply and 55% of all DEX volume, rivaled only by US-based USDC (which, compared to Tether, only has 16% as many active addresses).

Tether was founded in 2014 and was the first way for users of cryptocurrency exchanges to get access to a product similar to a digital dollar — this was difficult at the time especially for exchanges which lacked access to traditional banking infrastructure. Also, it became a way for blockchain users to make transactions denominated in dollars without leaving a blockchain at all.

|

|

|---|---|

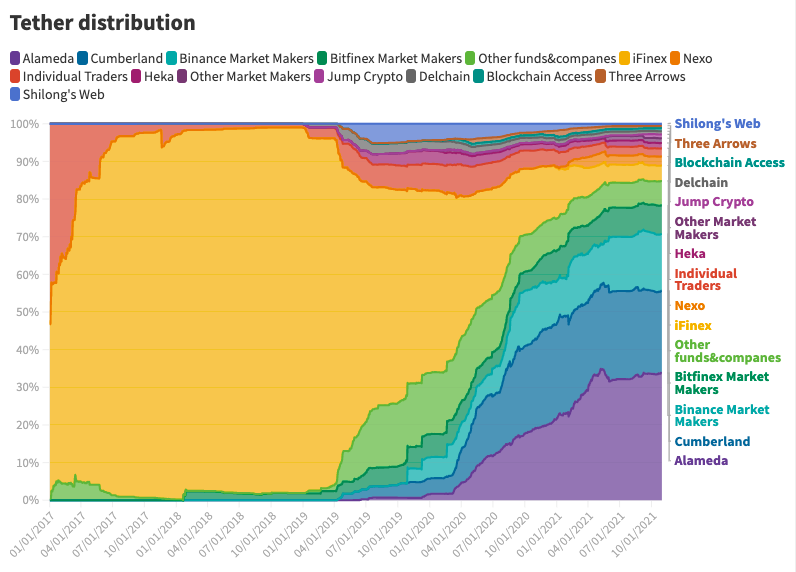

Tether facilitated cryptocurrency exchange banking and arbitrage

Between the start of 2016 and the end of 2017 the market cap of USDT grew 1000x from $1M to over $1B when excitement around cryptocurrencies surged dramatically. The rise of exchanges made USDT critically important with users wanting to transact in dollar denominations within those exchanges. USDT fulfilled some important useful functions in the cryptocurrency industry when it first launched:

-

An alternative bank for exchanges. For cryptocurrency exchanges that had their bank accounts disconnected from traditional fiat systems, they could support Tether and allow deposits and withdrawals into the exchange that way instead.

-

Inter-exchange financial rails. Tether acted as a reliable “tether” between all of the cryptocurrency exchanges so that accounts with USDT balances could deposit between them, for example moving funds from Binance to Bitfinex. This led to an enormous opportunity for arbitraging price differences across exchanges.

Funds realized that arbitrage opportunities existed in moving assets from one exchange to another to take advantage of pricing differences, or to purchase assets only available on certain exchanges. This same trend was accelerated dramatically in recent years, exacerbated by the growth of DeFi and maturation of crypto markets.

During the last bull market run, the largest single recipient of newly minted Tether was Sam Bankman-Fried's market making firm.14 Alameda Research famously made enormous profits on arbitraging differences in prices between the Korean and American markets.

|

|

|---|---|

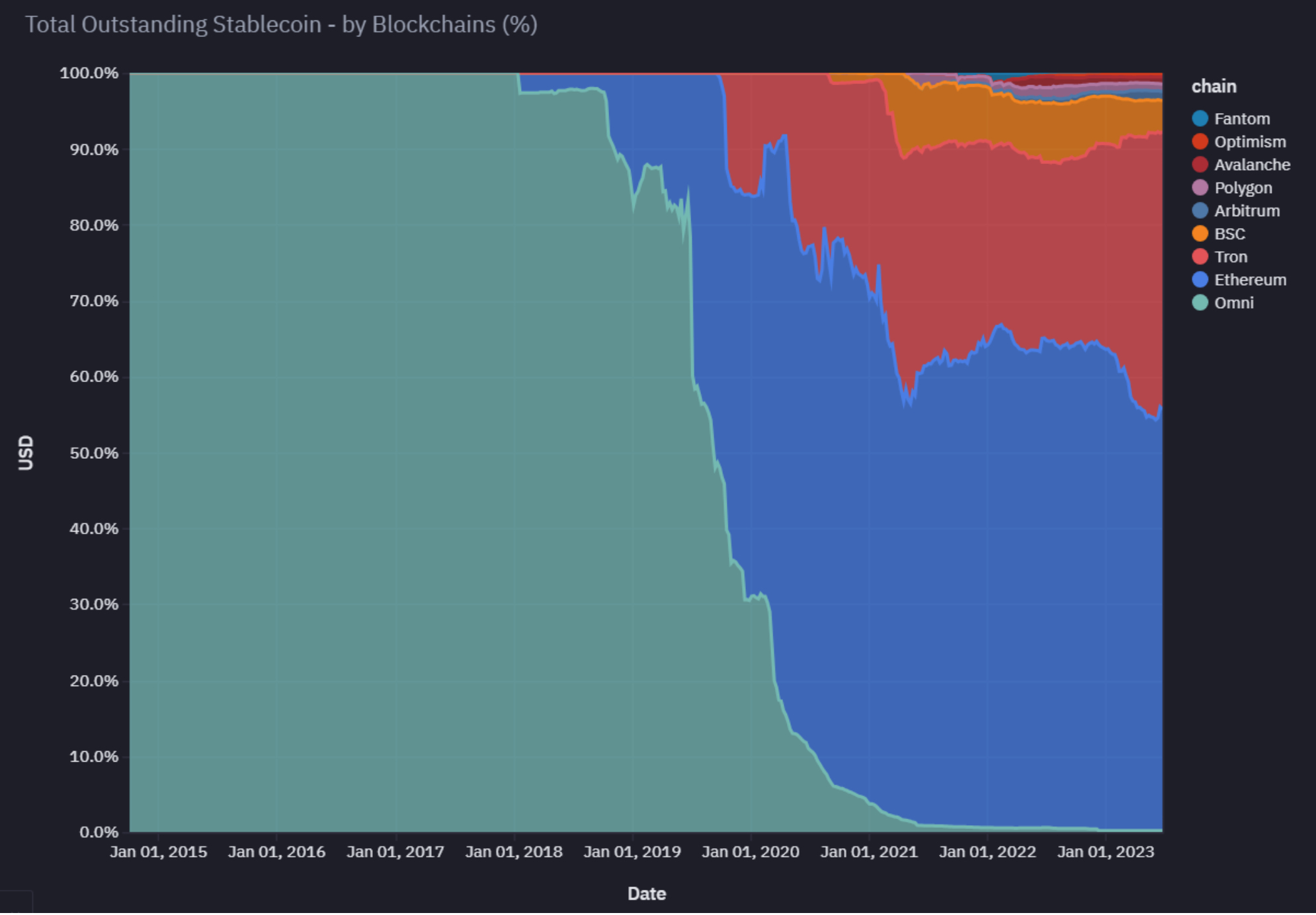

Tether’s supply started to move onto Tron

Tether was first issued on top of the MasterCoin protocol, an extension to Bitcoin intended to support more kinds of currencies than BTC. Later, Ethereum would be the place where the majority of new Tether supply was issued as the ERC-20 standard took off, enabling more pairs to be tradable directly on the Ethereum blockchain and thus driving more demand for USDT there.

Later, however, Tron entered the arena with a fork of ethereum that promised extremely cheap and low-latency settlement. Justin Sun, its founder, was exceptionally good at ensuring Tron became used for inter-chain settlement in the way Omni and Ethereum were doing.

Although it’s unclear exactly what deals Justin Sun brokered, he was able to position Tron in such a way that enormous amounts of USDT began settling on it. At the time, Tron had extremely low fees and fast block times, which was also very helpful for market makers that wanted to move between exchanges quickly using Tron.

So, today, Tether has an outstanding supply of more than $44B worth of USDT on Tron, even more than there is USDT on Ethereum Mainnet ($39B).

|

|

|---|---|

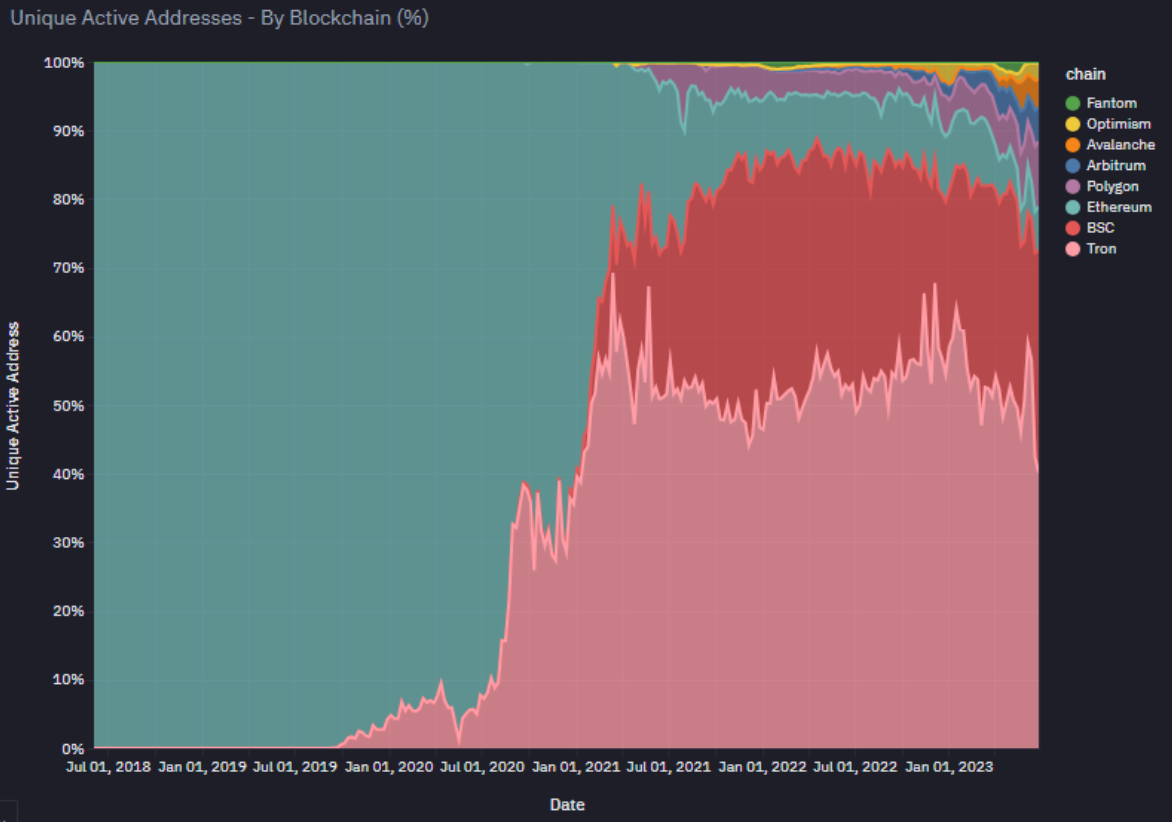

The majority of consumer stablecoin transactions use Tether on Tron

Use cases for USDT on Ethereum tends to be for higher-value holdings and transactions whereas Tron has become more frequently used for smaller transactions. The average stablecoin transaction on Ethereum is 13x the value of the average stablecoin transaction on Tron.

Today, ~5M weekly active stablecoin addresses transact using stablecoins and 75% of them less than $1k per week1, indicating that retail users likely represent the majority of stablecoin addresses. Most of that activity is using Tether on Tron.

While Ethereum was too expensive for small transactions and too slow for time-sensitive ones, Tron, bolstered by its exchange integrations, was able take advantage of the moment and took off quickly for consumer use cases like payments.

|

|

|---|---|

Binance helped make Tron the default for holding USDT

Binance played a massively important role in Tron’s early success. The exchange was one of the first to ever list Tron’s native token, TRX, which helped boost its credibility. In the early days of Tron’s adoption curve, Binance also facilitated transactions on the network for free!

Additionally, Tron was the default blockchain for depositing and withdrawing Tether on the exchange. Why it did this, and what the business agreements were between Justin Sun and Changpeng Zhao are unclear, but it definitely worked really well.

Since Binance has significant operations throughout Latin America, Africa, and Asia, users with Binance accounts were mainly getting access to Tether on Tron via deposits and withdrawals on the Binance App. Over time, this set a precedent, deeply embedding Tether on Tron as the default choice for many retail users.

Compared to Coinbase, which has always been seen as a user-friendly platform primarily serving the US market, Binance’s approach was more global from the outset. Coinbase’s regulatory-compliant stance and focus on the US meant it moved at a more measured pace internationally.

Huobi, on the other hand, had a stronghold in the Asian markets but didn’t expand as aggressively or innovatively as Binance in terms of product offerings. Binance’s agility, combined with its wide range of services and focus on both developed and emerging markets, gave it an edge over these competitors.

As a result, Binance is now used by over 150M people in 180 countries and is also the largest holder of USDT, which is deposited there by its users.

|

|

|---|---|

How can Ethereum compete?

From the point of view of someone that has been working on Ethereum, it’s easy to look at the dominance of Tether, Tron, and Binance and feel like Ethereum has failed end users. But, I think that’s missing the point. Ethereum has been successful in many ways, but it’s just that the market for stablecoins has been dominated by companies that were willing to grow at all costs.

Ethereum hasn’t compromised on decentralization, security, or sustainable approaches to scalability. It’s been a slow and steady march towards a more decentralized and secure blockchain, and it’s been a long journey to scale. But, it’s been worth it. Ethereum remains the leading blockchain project for decentralization, security, and now has a clear path to scalability.

Ethereum scalability enables better products to compete

Because of mature specifications for protocols to scale execution costs of transactions like the OP Stack, and production blockchain networks to run them like Optimism, it’s now possible for developers to build EVM blockchain networks secured by Ethereum with extremely low fees that will soon be less than $0.01 per transaction.

Critically, these new category of blockchains have some very valuable features:

-

They’re “Secured by Ethereum”. Instead of having to bootstrap their own security, these networks are secured by Ethereum. This means that they’re able to benefit from the security of Ethereum without having to pay for it themselves. This is a huge advantage over having to build their own security from scratch.

-

They’re natively bridged to Ethereum. Other blockchain ecosystems simply don’t have anywhere near the scale and network effects of the Ethereum ecosystem. Rollups are natively bridged to Ethereum, which means that assets like ETH, USDC, WBTC, USDT, etc can be moved between Ethereum and these networks without any friction. This is a huge advantage over other having to use complex and often insecure bridging products to other blockchain ecosystems.

-

They’re easy to manage. As opposed to launching a brand new blockchain, these networks are built on top of the EVM, are governed by a collective of Ethereum developers, and can even be entirely hosted by external vendors (e.g., Conduit). This is a huge advantage over having to build tooling and infrastructure from scratch.

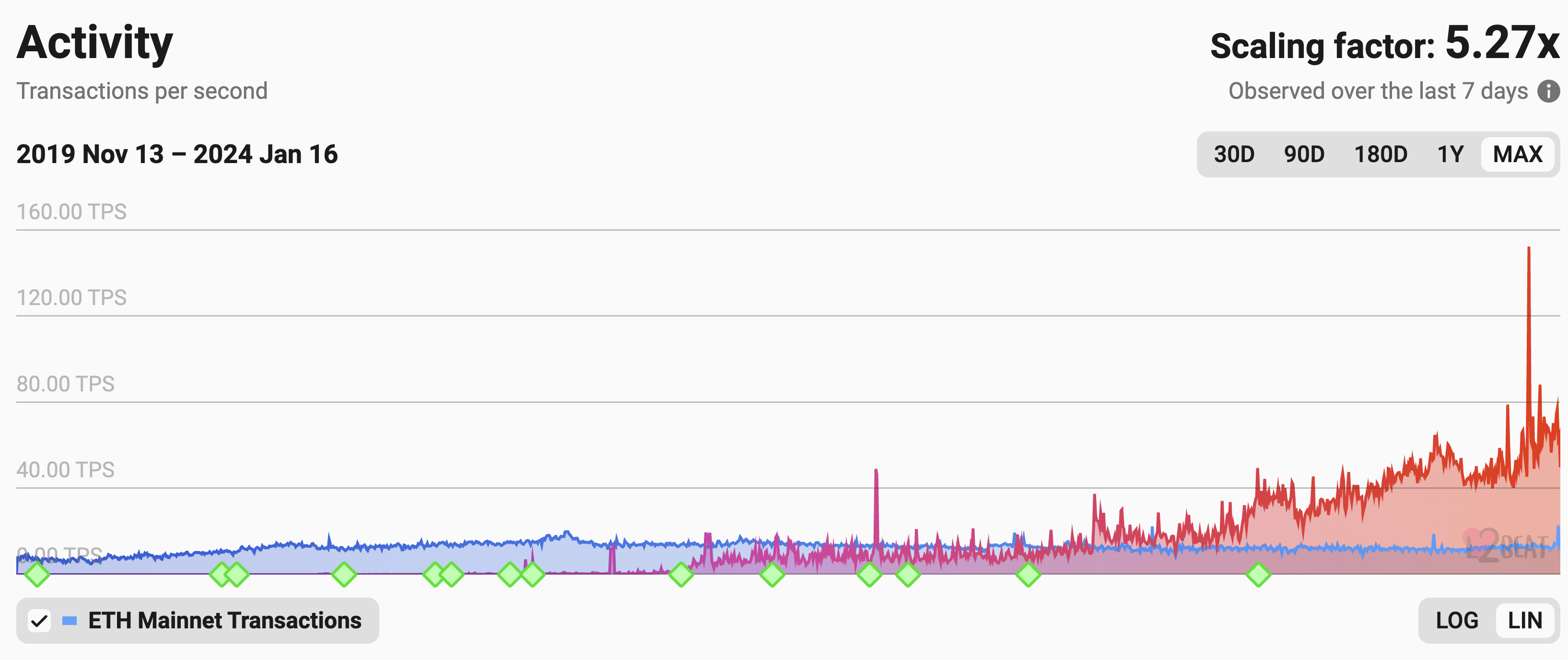

Last year, the total transactions per second on all L2s surpassed those on Ethereum Mainnet, and since then has reached an average of around 5x as many. This is a sign that the future of blockchain applications is going to be built on top of L2 networks secured by Ethereum.

|

|

|---|---|

Crypto commerce can be built on a scalable Ethereum

The most exciting recent example of a company benefitting from building a scalable rollup product on Optimism is Coinbase. Coinbase is the largest cryptocurrency exchange in the US, and they’ve built a product called Base that is a rollup built on Optimism and thus secured by Ethereum that has extremely low fees for end users.

With Base, Coinbase can start to bring its already strong brand and product to the rest of the world. They’ve already started to do this in Africa, where they recently announced a partnership with Yellow Card, to distribute USDC via its Wallet app and on Base. This is a huge step forward for Ethereum, and it demonstrates a pathway to compete directly with the deep social integration and network effects that Tether, Tron, and Binance have built.

Now is the perfect time to build stablecoin applications on Ethereum

While Tether, Tron, and Binance have been the dominant players in the stablecoin space for the last few years, I believe that’s going to change. The industry is moving towards a future where stablecoins are going to be issued by companies that are more likely to comply with regulations and that are going to be more transparent about their operations, and that’s a really good thing.

Fees on Tron are now far higher than they were when it first launched, Binance has serious competition emerging that can bring Ethereum to a more global audience, and Ethereum is now a viable option for stablecoin transactions via its L2 networks.

With all of these trends happening at once, it seems an awful lot it’s becoming the moment to seize back the consumer stablecoin market, this time secured by Ethereum, and for us to provide a better alternative to Tether on Tron!

Thanks to DC Posch, Polynya, Jesse Pollak, Josh Stark, Ansgar Dietrichs, Kenan Saleh, Faraaz Nishtar, Vishal Mathur, Nalin Bhardwaj, Sina Habibian, Haonan Li, Smit Vachhani, Jacob Willemsma, and others for helping read through some earlier drafts of this post, and chatting with me about these topics in general!

And, especially thank you to Peter Johnson from Brevan Howard Digital for his excellent report on stablecoins which many of the graphs in this post are from.

References

-

https://mirror.xyz/0x63F8A82711ECA999D5Cf588d5b7afE4DB673C7ED/ekt7LwxhuqZ4t1q5CN1oOHR3nlQGglMpaCB3ZBu2B3Y ↩ ↩2 ↩3 ↩4

-

https://coinmarketcap.com/charts/ ↩

-

https://www.prnewswire.com/news-releases/latin-america-s-crypto-conquest-is-driven-by-consumers-needs-819718066.html ↩

-

https://english.elpais.com/usa/2021-03-05/argentinas-perpetual-crisis.html#:~:text=Since%201921%2C%20when%20it%20was,peso%20ley%20from%201970%20to ↩

-

https://www.reuters.com/technology/cryptoverse-digital-coins-lure-inflation-weary-argentines-turks-2023-05-02/ ↩

-

https://wiki.lemon.me/lemon-cash-app/ya-somos-2-millones-de-usuarios/ ↩

-

https://dune.com/queries/2659241/4420459 ↩

-

https://www.circle.com/blog/circle-teams-up-with-mercado-pago-to-introduce-usdc-to-chile-customers ↩

-

https://decrypt.co/146481/mercado-libre-gives-mexican-customers-access-to-pax-dollar-stablecoin ↩

-

https://www.businesswire.com/news/home/20230905549860/en/Visa-Expands-Stablecoin-Settlement-Capabilities-to-Merchant-Acquirers ↩

-

https://bluechip.org/coins/usdt ↩

-

https://decrypt.co/150678/tether-reports-850-million-q2-profit-72-billion-exposure-to-us-treasuries ↩

-

https://decrypt.co/209640/cantor-fitzgerald-ceo-tether-bullish-bitcoin-halving-etf ↩

-

https://protos.com/tether-papers-crypto-stablecoin-usdt-investigation-analysis/ ↩ ↩2

-

https://www.ishares.com/us/products/239452/ishares-13-year-treasury-bond-etf ↩

-

https://www.barrons.com/articles/coinbase-circle-stablecoin-deal-dd016298 ↩